Binance ordered to stop all digital currency services in Belgium

Written by on July 1, 2023

“Binance is offering and providing exchange services in Belgium between virtual currencies and legal currencies, as well as custody wallet services, from countries that are not members of the European Economic Area,” the FSMA said.

Binance, which was founded by Changpeng Zhao in Shanghai in 2017, has grown to dominate the crypto industry but also faces scrutiny from regulators keen to clamp down on money-laundering.

Securities and Exchange Commission’s move this month to sue crypto giants Coinbase Global and Binance, alleging violation of its rules. The moves have revived investor interest in cyptocurrencies, which have been in the doldrums after a series of crypto company meltdowns including the sudden collapse of exchange FTX late last year.

Compounding negative sentiment has been increased regulatory scrutiny, including the U.S. The pair deny the allegations.

June 23 (Reuters) – Bitcoin, the world’s largest cryptocurrency, hit a more than one-year high on Friday, capping a week of gains helped in part by BlackRock’s plans to create a bitcoin exchange-traded fund (ETF) despite heightened U.S.

regulatory scrutiny on the digital asset sector.

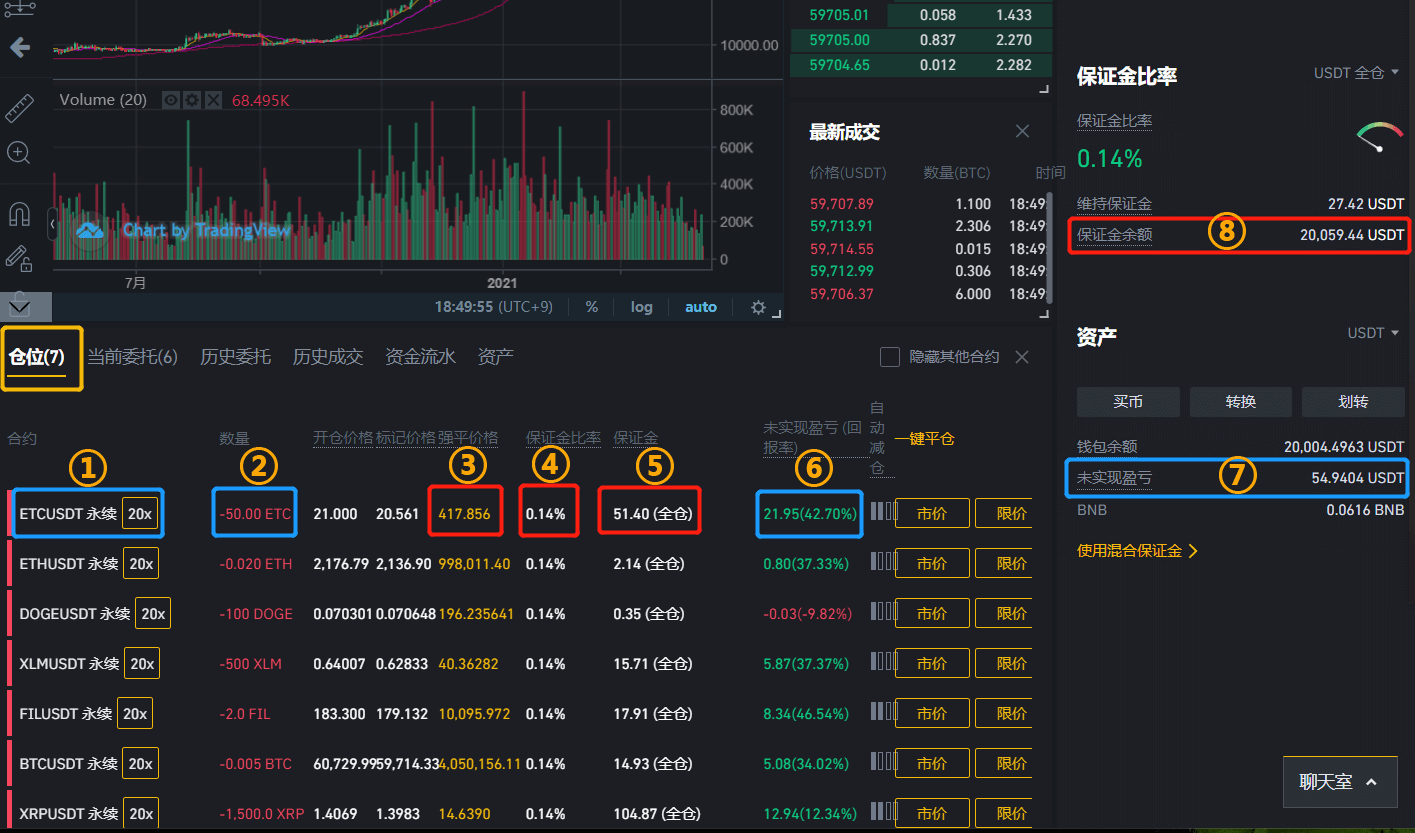

One of the biggest drawbacks of Binance as a futures trading platform is that it requires traders to first deposit Tether to trade.

One of the biggest drawbacks of Binance as a futures trading platform is that it requires traders to first deposit Tether to trade.

The platform relies on the controversial Tether stablecoin.

customer assets remain in the United States until a sweeping lawsuit filed this month by the SEC is resolved. Earlier this month, Binance and Binance.US entered an agreement with the U.S.

Securities and Exchange Commission to ensure U.S.

BRUSSELS, June 23 (Reuters) – Belgium’s FSMA regulator on Friday ordered Binance to cease offering any virtual currency services in the country, adding to pressure on the world’s biggest cryptocurrency exchange.

Conversely, the Binance Futures trading platform makes it possible for traders to speculate on price moving lower and consequently generate profits.

Cryptocurrencies’ prices do not always move up. Given the extreme levels of volatility, prices do experience severe downward price action.

Revenue factors play a vital role in the growth of a business, and such a worthy revenue-filled Binance clone script is a boon for those who wish to start a crypto exchange similar to Binance.

The number of Binance clone script providers has also increased, over years. Make sure you choose suitable clone script providers who have good ratings, reviews, years of experience, portfolios, and the price they charge, as some charge a lot of money for the Binance clone script.

So choose a budget-friendly yet good-quality product providing clone script provider for the best start for your Binance-like crypto exchange business.

Given that all futures contracts in the platform are traded in Tether, you will have to deposit some Tether to start trading.

All you have to do is open a regular Binance account then a Binance Futures tradingaccount to access the Futures interface. Trading futures contracts in the cryptocurrency market is straightforward.

A Binance clone script cost falls within the range of 3k USD to 12k USD. Compared to developing from scratch the Binance clone script is much cheaper in the price category. The reason for the range is because of the customizations made to the clone script and without those modifications the cost is even lesser than the above-mentioned price.

At times the advanced feature integrations.

We have seen the impressive revenue factors that a Binance clone script is comprised of and the obvious question that pops into everyone’s mind is the price of a Binance clone script.

How will I miss that important topic?

If you choose a third-party platform, you can automate your process by making use of Binance trading bots. The futures trading with bots on Binance lets traders divide their funds into smaller parts/grids, and buy the asset at fixed intervals.

Apart from this, you can also make a personalized strategy by connecting your account on third-party terminal to the Binance Futures platform.

For Binance Futures contracts, grid trading bot automates the buying and selling process.

This feature is designed to place orders in the market at preset time intervals within a configured price range. Once the crypto bot Binance or the grid trading bot is created, 币安 the system will automatically start buying and selling of the orders.

Users can customize and set certain grid parameters, to determine the upper and lower limits along with the number of grids.