Universal’s street-racing franchise is far more dependent on the country than other big Hollywood tentpoles like ”Guardians of the Galaxy Vol. 3“

Some plugged-in observers are holding out hope that China will snap back and become a steady contributor to theatrical revenue once more. “I don’t think it’s back to normal, because it’s not a light switch, it’s a faucet,” Imax CEO Richard Gelfond said Wednesday at a JPMorgan investor conference. “But I think it’s headed in that direction at a rapid pace.”

That may be optimistic, if the $500,000 opening-day take for “The Little Mermaid” in China is any indication.

While Hollywood movies have been performing below par since the pandemic shuttered China’s box offices and the country then had a rocky reopening, 2021’s “F9” was an exception to the rule. It earned $134 million in its weekend debut in China and ended with $215 million — an impressive 29% of its $727 million global gross, and more than its $173 million domestic take. If “Fast” is faltering, what hopes do other Hollywood franchises have?

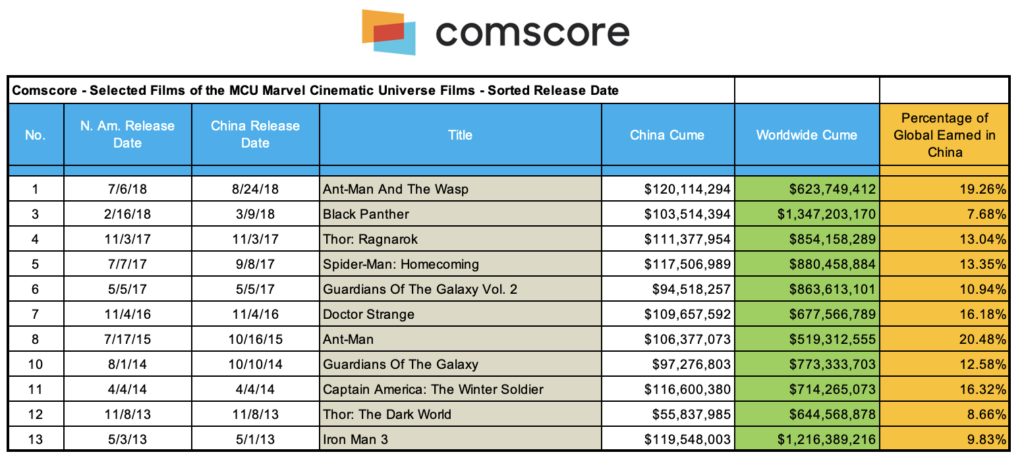

Marvel’s China struggles

Take “Guardians of the Galaxy Vol. 3,” which has taken in $75 million so far in China, about 11% of its $670 million global box office to date. That’s a near return to form for the Marvel Cinematic Universe movie: “Guardians Vol. 2” earned $95 million in the country, about 10% of its global total.

But another Marvel release, “Ant-Man and the Wasp: Quantumania,” flopped with $39 million at the box office in China. Not only was that two-thirds below the $120 million earned by “Ant-Man and the Wasp” in 2018, but it was also about 8% of the $476 million global total for “Quantumania.” The first two “Ant-Man” films earned about a fifth of their total box office in China.

That’s well above the average for Marvel films, which typically earned 15% of their global box office in China pre-pandemic.

The upside for Marvel may be that China’s near-ban on its films, only recently softened, and the subsequent drifting away of the audience for American superhero movies as a result, may hurt it less, since most of its films made a relatively small percentage of box office there.

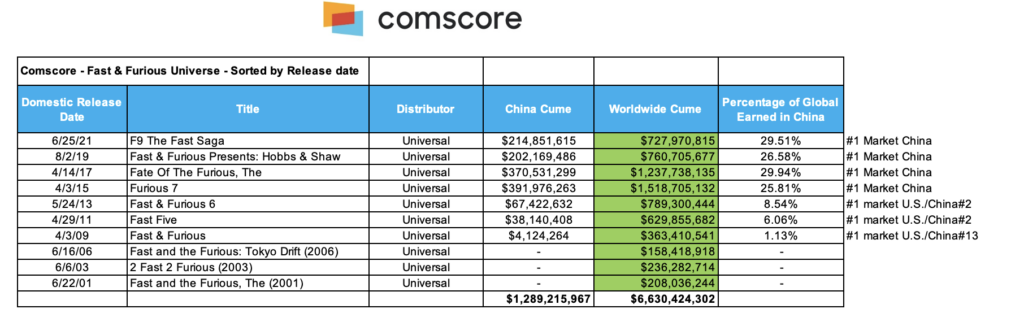

“Fast” money in greater China

Vin Diesel’s “Fast” series didn’t make noise in China until “Fast & Furious 6” earned $67 million out of its $789 million total in China a decade ago. “Furious 7” was supercharged in North America thanks to the tragic death of Paul Walker, the added value of Jason Statham as a baddie and the film acting as a kind of generational franchise coronation. It earned $353 million domestically but also a sky-high $392 million in China, setting a record for any movie, Hollywood or Chinese, in that quickly growing territory. That made up a staggering 26% of its $1.519 billion global total, setting a benchmark for subsequent films.

“Fate of the Furious” earned $226 million domestically in 2017, in line with the inflation-adjusted earnings of the previous films. It earned another $370 million in China, which was 30% of its $1.238 billion global total. By comparison, “Wonder Woman” earned $105 million of its $821 million cume in China, or 13%, that summer and “Despicable Me 3” earned 15% ($153 million) of its $1 billion cume in China.

From “Furious 7” to “F9,” “The Fast Saga” earned a combined $1.2 billion of its combined $4.231 billion in China alone, averaging out to 28%.

There are many factors behind the popularity of the “Fast Saga” in China, from the eagerness of star Vin Diesel to promote the films in China — he recorded a special greeting for Chinese fans for “F9” — to the vagaries of global politics.

Universal, said Chris Fenton, a Hollywood producer and author of “Feeding the Dragon,” has done a better job of managing its relationship with Chinese authorities than Disney. He noted that Chinese firms have a higher ownership stake in Universal’s China theme park than in Disney’s competing property.

“Fast X” could still earn a global total on par with “F9” even with a lower overall total in China. At the end of its first weekend, its worldwide box office stands at $319 million, with just 24% of that from China. It’s making up some of that in fast-developing markets like Mexico, India and Brazil, but it still has to sting after years of breaking records.

Ultimately, having a franchise that’s less dependent on such a risky market could be a better long-term position. “Consumers consume, but Beijing can tip any scale in any direction they please,” said Fenton.

watch avatar the way of water full movie

watch avatar the way of water full movie

watch avatar the way of water full movie