The lure of Singapore: Chinese flock to ‘Asia’s Switzerland’

Written by on January 15, 2023

Shortly after opening its doors on a Tuesday morning in mid-December, the Rolls-Royce showroom in Singapore’s Redhill neighbourhood was already bustling. US-China tensions remain high, financial markets are skittish, the risk of global recession looms heavily: it is the perfect time to put down an $80,000 deposit on a hot pink Phantom.

The number of Rolls-Royce cars registered in Singapore surged in 2021 and remained at record levels in 2022 — waiting lists for the cars now stretch into years. One type of buyer dominates. For the cars that leave the forecourt, a predictable future in the city-state awaits — shuttling the short routes between the mansions and apartments of Sentosa and other pockets of extreme wealth to luxury shopping malls, the discreet offices of their family funds and the private clubs of Orchard. According to employees at the showroom, the new buyers are overwhelmingly Chinese.

The flows are part of a transformation of Singapore that is becoming a proxy for the way in which one segment of China is dealing with geopolitical tension and decoupling.

Chinese individuals, their families, their companies and their advisers, according to a wide range of bankers, lawyers, accountants and investors interviewed by the Financial Times, now see Singapore as the vessel that can navigate them through a series of expected storms. At the same time, they add, it is becoming an increasingly vital place for outposts of Wall Street and the global financial industry to interact with them. For many years, Singapore has liked to sell itself as the Switzerland of Asia. The new cold war, says one former top official, is finally turning that pitch into a reality. The big question, though, is how far Singapore will tolerate being Switzerland with Chinese characteristics.

“This is a dramatic, epochal realignment of wealth in Asia. Capital moves as quickly as it can to the safest destinations with the highest rate of return. In Asia, that place is increasingly Singapore,” says Drew Thompson, visiting fellow at the Lee Kuan Yew School of Public Policy in Singapore.

The change on the ground in Singapore is palpable. Property deals by mainland buyers are the dominant transaction and the international schools are bursting at the seams, with hundreds of Chinese applicants for a vanishingly small number of places. Chinese Michelin-starred restaurants might — just — be able to find diners an available dinner booking next April.

Singapore’s status as an Asian financial hub has been doubly enhanced by the Chinese influx. The number of Chinese family funds in Singapore has soared from a handful a few years ago to an estimated 600 today. At the same time, some 500 Chinese businesses have registered in the city in the past year, preparing to use their Singapore-based status to venture more boldly into India and other jurisdictions where they face obstacles.

There is exponentially more business for private wealth managers and other financial services and, as the scale of activity has grown, it has made sense for many of the largest US, European and Japanese investment banks to shift more of their senior staff to Singapore from Hong Kong.

“I think many mainland China clients still see Singapore as a safer long-term bet than Hong Kong for a few reasons. First is political stability, second is economic stability and finally, its rising status as Asia’s financial hub,” says Kia Meng Loh, co-head of private wealth and family office practices at Dentons Rodyk, a law firm.

But for all the signals that Singapore has found itself in a prime position to thrive amid geopolitical uncertainty, the story has distinct vulnerabilities. China’s tolerance of what has been happening — the exodus of capital and individuals — will eventually have a breaking point that may come with consequences.

Singaporean society could also push back, warn senior figures close to its government. The cost of living has soared in Singapore, angering locals who see danger and division in the rising rents, the bursting schools and the growing number of Rolls-Royces. Meanwhile, the inflow of so much capital so quickly also exposes Singapore to the potential for bad actors using it as a spot to hide money.

“Capital is always moving. And it, and the people controlling it, can just as easily flow back out,” says one investment banker based in the city.

Draw of stability

Singapore has been a hub for Chinese migration and capital since it was first declared a freeport by Sir Stamford Raffles in the 19th century. Roughly three-quarters of Singapore’s 3.5mn citizens are ethnically Chinese, making it culturally an easy fit for the newest arrivals.

“Chinese money has always had a significant role to play in Singapore’s economy, even before Singapore became the Singapore we know today,” says Yinglan Tan, head of Insignia Ventures, a Singapore-based venture capital fund with many Chinese backers.

That appeal has grown during the pandemic. As China sealed itself off from the world, employed harsh lockdown measures and cracked down on wealth as part of a “common prosperity drive”, some in mainland China looked overseas.

As many parts of the world, particularly the west, have become more wary of Chinese investment and business, Singapore’s neutrality, stability, low taxes and low corruption makes it an obvious choice.

Investment migration consultancy Henley & Partners has had a significant spike in migration inquiries from Chinese nationals in 2022, which are up 83 per cent by end of November compared to the full year 2021. In the top two positions were Greece and Portugal, which offer “golden visas” that grant residence without having to spend time there. Singapore was in third place.

“Generally in pure investment migration programmes, such as Portugal, the vast majority of people don’t move. Singapore and China are different. A lot do want to move physically,” says Dominic Volek, head of private clients at Henley & Partners.

One of the most obvious areas where this flow of Chinese capital can be seen is in family offices, the private wealth management firms set up for rich individuals and their relatives. If they are domiciled in Singapore, family offices qualify for tax exemptions. Coupled with the city’s stability and a globally respected financial regulator, the numbers of the funds have exploded. Approvals are taking months as the Monetary Authority of Singapore grapples with the surge.

Singapore has gone from some 50 family offices in 2018 to 700 by the end of 2021 and lawyers and wealth management advisers estimate that number reached about 1,500 by the end of 2022. IQ-EQ, an investor services firm, estimates about 40 per cent of that total are mainland Chinese.

Wang Jue, a 35-year-old from Chengdu in China, represents one of many of the Chinese entrepreneurs venturing overseas and choosing Singapore as a business base.

Wang says he shifted more assets from his Hong Kong family office to a new Singapore family office set up in 2021. The art collector and investor, who lives in China but visits Singapore frequently and owns property in the city, has more than 300 pieces from Czech artist Alphonse Mucha that he wants to set up for viewing in the metaverse.

“Singapore is a choice globally, not just Chinese,” he says over a Zoom interview, with work by US artist KAWS, Japanese painter Yayoi Kusama and a Ming dynasty antique in the background. “The politics are stable, the economy is stable and finally, it is a finance centre so capital can flow easily in and out.” Singapore has not had to confront the sort of mass street protests that were seen in Hong Kong, he says.

Many of those family offices go on to set up other types of structures such as offshore funds. The number of investment funds launched as part of a 2020 government scheme designed to lure money from rival low-tax jurisdictions has surged to 776 at the end of 2022 (from 470 at the end of 2021), according to figures from Singapore’s accounting authority. Called a Variable Capital Company (VCC), the vehicle is meant to attract those who traditionally looked to jurisdictions such as the Cayman Islands to house assets.

Caroline Lee, who advises Chinese clients with a family office in Singapore, agrees with Volek of Henley & Partners that Chinese are increasingly looking to move physically to Singapore. Opening a family office opens the door to getting a visa to live and work in Singapore, she says. “Many travel to and fro. They see Singapore as cosmopolitan. They can speak Chinese or English and it is easy to adapt.”

One of the key attractions is Singapore’s education system, seen as one of the best in the world. The vice-principal at one of the city’s large international schools says anecdotally that of the last 20 families accepted at the school half had been from China.

“Often we do not even deal with the parents. We deal with the manager and what they call the ‘communicator’ — basically a translator,” the vice-principal says, speaking anonymously because of sensitivities involved. “Often one or both parents are travelling in and out of China. They pay a fortune to buy or rent a luxury unit nearby and then the kids live with the maid, the manager and the communicator.”

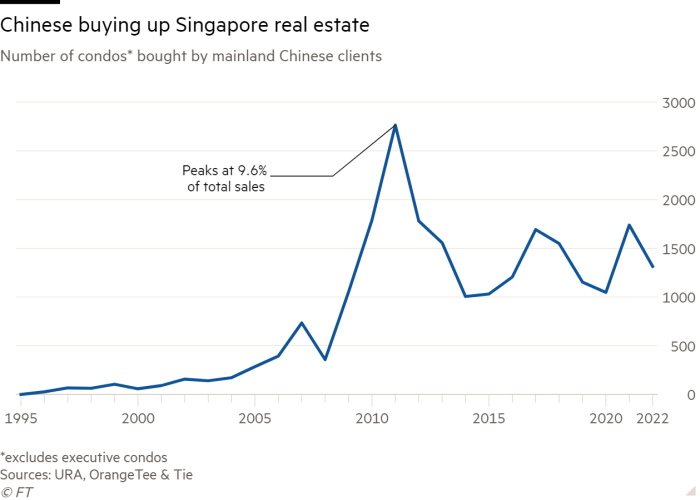

This is borne out in real estate data, which show two strong years of property purchases in Singapore by mainland Chinese. According to government data, Chinese citizens bought 1,738 flats in 2021, which was 50 per cent higher than in 2019 and the most since 2012. Purchases were slightly lower, but still a historically high 1,314 units in 2022.

Private residential property rents hit a record high in 2022, surpassing the previous peak in 2013, according to Urban Redevelopment Authority data — the last time Chinese mainlanders were heavily buying Singaporean residential property.

“What our agents are telling me is that they are expecting more sales with the reopening of China,” says Christine Sun, senior vice-president of research from OrangeTee & Tie, a property research consultancy. “This past year a large portion have been luxury buyers. Once China relaxes we are expecting more buyers in even suburban areas.”

“A lot of mainland buyers that have become Singapore citizens or permanent residents are buying units in bulk,” she adds. Singaporeans and permanent residents avoid higher stamp duty fees on property purchases — the tax for foreign buyers was lifted from 20 to 30 per cent in 2021 to cool the market.

All of this together has put Singapore in an enviable position globally as an international wealth hub. A record S$448bn ($339bn) in asset management inflows was recorded in 2021, 15.7 per cent higher than the previous year, the latest data from the Monetary Authority of Singapore show. By comparison, net fund inflows in Hong Kong for asset management for 2021 was HK$1.514tn ($194bn), compared with HK$1.379tn in 2020, according to the city’s Securities and Futures Commission.

‘Existential risk’

That realignment of wealth has brought tantalisingly closer the city’s long-held ambition of being a deeper and self-sustaining financial hub.

“The thing that Covid did for Singapore was that prior to the crisis it really struggled to have that community of finance professionals to the extent that it became self-sustained. Now the flow is here. The decision makers are here. Walking distance from my office I can meet lawyers, asset managers, portfolio managers, someone running a family office, someone wealthy wanting to set up a family office. Prior to the pandemic it wasn’t as deep,” says Michael Marquardt, Asia chief executive of IQ-EQ, an investor services firm that sets up family offices.

At a time of intense geopolitical rivalry between the west and China, Singapore remains open and welcoming of both.

“You can be Chinese, come here and eat Chinese and do business and have a network. If you are from New York, you can come here, eat your food, do business and have a network,” Marquardt adds.

Singapore has also stolen important conferences from under Hong Kong’s nose. SuperReturn Asia, Asia’s leading private capital conference, last year was held in Singapore for the first time and attracted large companies and investors from all over the world, including China.

“When Singapore wants something, the whole machine gets behind it. Singapore Venture Capital Association co-hosted [the event], Singapore Tourism Board provided sponsorship, the Monetary Authority of Singapore and other agencies provided content, the sovereign [investors] were supportive and spread the word,” says Shane Chesson, a founding partner of Singapore’s Openspace Ventures who was involved in moving the conference location.

“They’ve played a blinder but they also move quickly and don’t squander the opportunity,” he adds.

Still, many in Singapore hesitate to say the shift is permanent. If rich Chinese feel that the current level of repression is lessening, that could reduce the number of people seeking an exit. But even more worrying, say experts, is the potential for Beijing to look at Singapore’s welcome to China’s wealthy and their accompanying flows of capital and seeing it as an opportunity to extend its influence.

“You run the risk of China being covetous of Singapore as a Chinese outpost. The more Sinicised and mainland it becomes, the more it could be seen as a part of greater China,” says Thompson. “It is an existential risk.”

The other issue Singapore’s ruling party is grappling with is the impact on the city’s carefully managed societal mix. The government for instance sets ethnic quotas in public housing — where about 80 per cent of Singaporeans live — as a way of trying to ensure racial and religious harmony.

Cracks are emerging. The conversations among wealthy — and aspiring wealthy — Singaporeans and other parts of its establishment regularly turn to complaints about the new Chinese nationals building “enclaves” or “mini Chinatowns” in certain neighbourhoods.

But the clearest indication of unhappiness among the local population is the cost of living, and especially rising rents. According to data from the URA, rents for private homes surged 8.6 per cent in the third quarter, which was the steepest growth since 2007. Rents for private apartments, dominated by foreigners and expats, and government-subsidised housing, where most citizens live, are soaring.

“The government was quite happy for people to blame Hong Kong expats. But it has become pretty clear that while that was a contributing factor, the real reason for the eye-popping prices has been the Chinese buyers, many of whom are willing to pay double the asking rent, or pay millions in cash for properties that sit empty,” says one real estate agent.

There is a concern that at some point the Singapore authorities will face ever louder complaints from the middle class, and, potentially, from the thousands of foreign professionals living and working there. If the quality of life changes, a lot of that wealthy capital might move on, experts warn.

In this respect, Hong Kong’s swift transformation under a new national security law and its loss of business and people due to Covid restrictions offers a cautionary tale for Singapore on how quickly a city’s fortunes can change.

Singapore, sums up Simon Tay, chair of the Singapore Institute of International Affairs, is in a sweet spot as globalisation slows.

“In a world where China is looking for friends, it gets a warm reception in Singapore. At the same time, Wall Street and US companies increasingly see us as a premium alternative to other hubs,” he says.

“There is much to navigate and all depends on not having to make a choice [between the west and China], because that would force Singapore to destroy value. Cold wars are all about value destruction.”

watch avatar the way of water full movie

watch avatar the way of water full movie

watch avatar the way of water full movie